Forecasting revenue doesn’t have to be scary or spreadsheet-only. If you want a practical way to predict cash coming in over the next 90 days, this simple method will get you there in under an hour. Use it to spot shortfalls early, plan marketing or hiring, and make smarter decisions, especially if your business has irregular income or seasonal swings. Below I walk you through a clean, step-by-step process you can use today, with examples and a ready-to-use checklist.

Why forecast revenue for the next quarter (and why 90 days matters)

Short answer: ninety days is long enough to cover client billing cycles, payroll dates, supplier payments and seasonal shifts, but short enough to be actionable. Forecasting the next quarter gives you an early-warning system: you catch cash dips before they become emergencies. For service businesses in Canada this matters more because HST/GST remittances, payroll schedules, and monthly billing can create timing gaps that look small on paper but bite your bank balance.

Step 1: Gather three simple inputs

Before you start, open your accounting tool, calendar and client list. You only need three inputs:

- Confirmed revenue: invoices already issued with expected payment dates (or signed contracts with payment schedules).

- Probable revenue: proposals out, deals in negotiation, or recurring clients who usually pay. Assign a probability (e.g., 70%).

- Historical run rate: average monthly sales for the last 3 months (or same quarter last year if seasonality matters).

Tip: Keep everything in Canadian dollars and note expected payment terms (EFT, e-transfer, credit card) because actual cash timing may differ by payment method.

Step 2: Build a simple 90-day forecast table

Create a 3-column table (Date / Expected Inflows / Notes) broken into weekly or monthly rows for the next 90 days. Monthly is easiest; weekly gives more precision. The historical run rate column is for comparison/benchmarking, not something you add directly into projected totals

Example monthly layout:

| Month | Confirmed inflows | Probable inflows (weighted) | Historical run rate | Projected total |

|---|---|---|---|---|

| May | $12,000 | $4,000 × 70% = $2,800 | $15,500 | $14,800 |

| Jun | $8,000 | $10,000 × 50% = $5,000 | $16,200 | $13,000 |

| Jul | $5,000 | $6,000 × 80% = $4,800 | $13,000 | $9,800 |

How to weight probable revenue: multiply the deal value by a conservative probability (50–80%) based on how advanced the sale is. This avoids counting pipeline as guaranteed cash.

Step 3: Adjust for payment timing and terms

An invoice issued today doesn’t always mean cash today. Adjust your forecast for realistic payment timing:

- E-transfer / Interac etransfer: often 0–2 days.

- Credit card deposits: typically 1–3 days after payment processing.

- e-invoicing / cheque / manual payments: can be 7–30 days.

- Large contracts: check milestone payment dates.

Add a “Timing factor” column to push expected inflows to the month they’ll actually hit your bank. This step is the difference between a forecast and a true cash plan.

Step 4: Validate with a conservative scenario

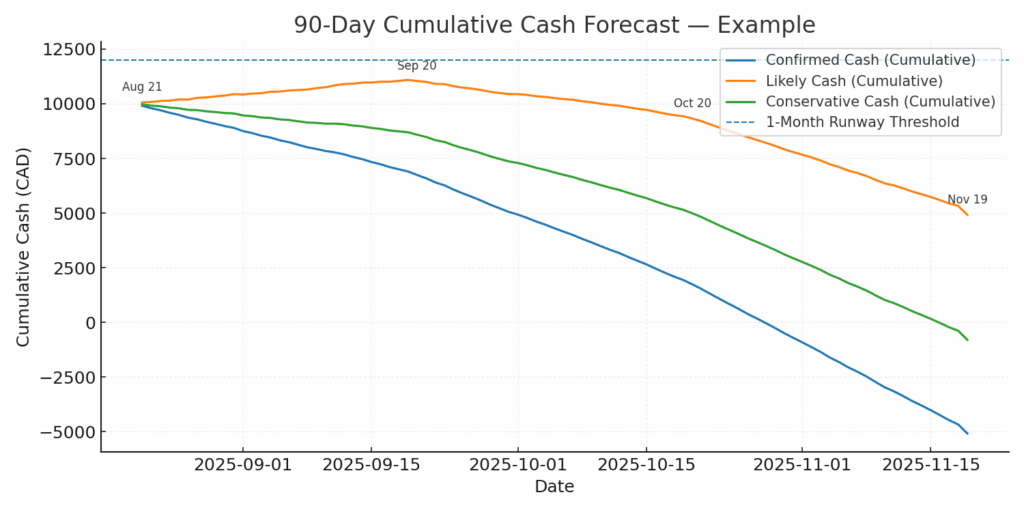

Create a “likely” and a “conservative” scenario. For the conservative scenario, reduce probable inflows by 30–40% and assume slower payment timing. This gives you a buffer and helps you plan contingencies (e.g., temporary cost pause or short-term financing).

Why this matters: profitable businesses plan for downside; struggling ones assume best-case. Make conservative the default and you’ll rarely be surprised.

Step 5: Link the forecast to actions (the weekly checklist)

A forecast is only useful if it triggers actions. Use this weekly checklist:

- Week 1: Chase overdue invoices from the confirmed list.

- Week 2: Confirm payment dates with clients for large receivables.

- Week 3: Postpone nonessential spend if projected cash falls below one month runway.

- Week 4: Consider a short-term line of credit or micro-loan only if the conservative scenario shows a gap.

If you see a shortfall more than 30 days out you have time to act, negotiate payment terms, offer an early-payment discount, or shift a marketing spend.

Quick formulas you can paste into a sheet

- Weighted probable revenue:

Deal Value × Probability (0.5–0.8). Start conservatively and you can always run different scenarios. - Projected monthly revenue:

Confirmed + Sum(weighted probable revenue) + (Historical run rate adjustment) - Cumulative 90-day cash:

Opening cash + Sum(Projected monthly revenue) − Sum(Projected monthly outflows)

Use the 90-Day Cash-Flow Planner to plug numbers in and see cumulative cash automatically. It’s a fast visual check of runway and shortfalls.

Example: small marketing agency (realistic scenario)

- Opening cash: $8,000

- Confirmed monthly inflows: $6,000 this month (client retainer)

- Probable inflows: two proposals totaling $10,000, one 70% likely, one 40% likely → weighted = $7,800

- Historical run rate: $12,000/month

Projected Month 1 = $6,000 + $7,800*(pro-rated to month) vs timing. If timing shows a $3,000 dip in month 2, decide: chase invoices, offer a 2% early-pay discount for a week, or delay a planned software subscription renewal.

Tools and tips for Canadian businesses

- Account for HST/GST: if you collect HST, don’t forget remittance timing. A forecast that ignores HST can overstate available cash. But since HST/GST make sure you extract it from your total revenue calcs above. See CRA guidance on HST collection and remittance.

- Include payroll liabilities: payroll taxes and employer contributions often hit monthly or biweekly, add them to your outflows calendar.

- Seasonality: Canadian businesses often see summer slowdowns (July/August) or year-end spikes, use last year’s quarter as a reality check.

From forecast to confidence: what to review each week

- Opening cash vs projected closing cash for the coming 30 days.

- Biggest single expected inflow and its confirmation status.

- Top three outflows you can control this month.

- One small win: chase a late payment or pause a subscription.

Make this a 10–15 minute weekly ritual and you’ll stop reacting to cash surprises

Final note

If you want a plug-and-play version of this method, the Free 90-Day Cash-Flow Planner does the math and shows cumulative cash so you can spot shortfalls visually. For a one-to-one check, a short Business Clarity Session can help you validate assumptions and make a practical action plan.

Start with conservative assumptions, update weekly, and let the forecast drive simple actions, chase invoices, confirm contracts, or pause spend. A clear 90-day forecast turns guesswork into decisions.

Ready to take control of your cash flow and forecast with confidence? Join the Money Moves program for step-by-step guidance and practical tools that make financial planning simple.

Disclaimer: The strategies discussed are general in nature and may not fit your specific circumstances. This article does not constitute assurance, tax, or investment advice. Consult a CPA or registered investment professional before acting.